The university is looking for authorization to negotiate a lease agreement on the Romania Property, a four-acre lot south of Franklin Boulevard between Orchard and Walnut streets. If approved, the building would be vacated in July to begin construction. The project is currently in the design phase.

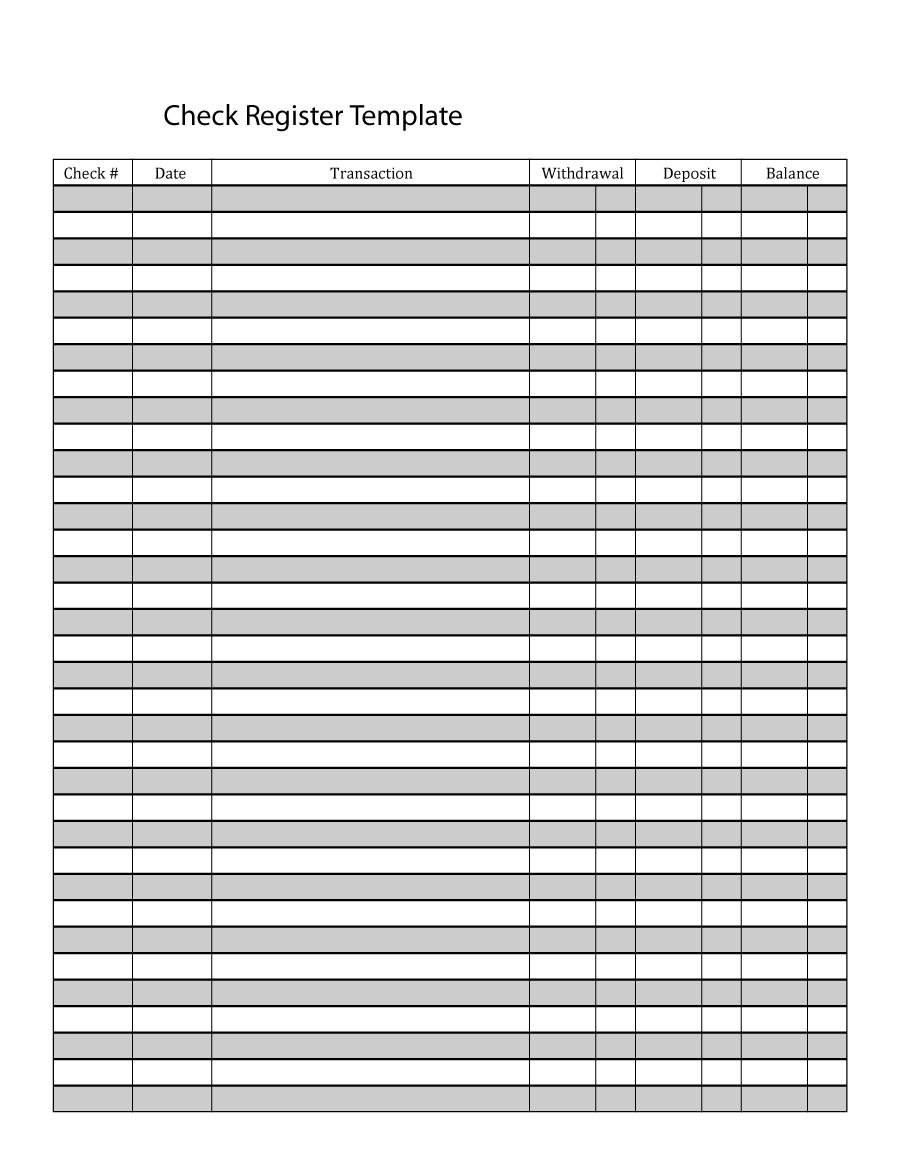

Practice for checkbook registers full#

The Heritage Project, which is a deferred maintenance project on University and Villard halls, is requesting full authorization for its projected $87.82 million budget. Other capital projects at University of Oregonĭuring Monday's Finance and Facilities Committee meeting, university administrators will be requesting authorization on several campus projects. The building will be open for occupancy in December 2025. The first building was completed and unveiled in 2021.Īccording to a UO news release, the new building will include a public café, floating central staircase and an open-air courtyard.īuilding 2 will double the campus’ capacity for research and development of new biomedical technologies with additional room for its expanding academic programs, expected to house 20 to 23 research groups at a time.Ĭonstruction began on the Knight Campus building 2 in April. When it is finished, the Phil and Penny Knight Campus for Accelerating Scientific Impact will consist of three buildings on the Riverfront Parkway, including about 420,000 square feet of research, academic and innovation space. During Monday's Academic and Student Affairs Committee meeting, the committee will hear a presentation on the plans. The UO recently released its design plans for building 2 of the Knight Campus. Written public comment will be accepted via until 5 p.m. Monday, 24 hours before the full board meeting. UO is accepting requests to speak during public comment until 9 a.m. All meetings will also be streamed on UO's YouTube channel. and will include the full board and action items to be voted on as well as public comment and updates from the Associated Students of UO.įor both days, the meetings will be held at the Ford Alumni Center, Giustina Ballroom, 1720 E 13th Ave. Monday, three committee sessions will be held: the Finance and Facilities Committee the Executive, Audit and Governance Committee then the Academic and Student Affairs Committee. He can be reached at 83.The University of Oregon Board of Trustees is gathering for its quarterly meeting Monday and Tuesday in Eugene Agenda items include discussions on capital projects, board leadership and budget reports.Īt 9 a.m. Most banks have user-friendly websites and will be happy to set you up with this service.īarry Dolowich is a certified public accountant and owner of a full-service accounting and tax practice with Monterey. In addition to reconciling your bank account, it is also a good idea to periodically review your account online for any unusual charges or transactions. Failure to timely reconcile your bank accounts can cost you money! If you do discover a bank error, report it to the bank immediately and be sure to follow up the correction. Please note that on occasion banks do make errors, or you could be the victim of identity or check theft. After a few months, you will become an expert at reconciling your checkbook and enjoy the satisfaction and peace of mind of knowing that you have an accurate balance. Most bank statements provide a reconciliation format as described above to help guide you through this process. The resulting total should equal the balance of your checkbook register. To balance, you need to subtract the outstanding checks and add the outstanding deposits to the ENDING bank statement balance. Once you have the above information, you are ready to reconcile your checkbook register balance to the bank statement balance. These are deposits you made that have not been credited to your account as of the ending date of the bank statement.

You will also need to make a list of any outstanding deposits. These are checks that you have written, but have not been charged by the bank as of the ending date of the bank statement. You will need to make a list and total all outstanding checks. You may need to enter legitimate receipts or charges (i.e., interest income, bank charges and fees, etc.) in your register. To do this, you will need to “check” off all the items (deposits and withdrawals) in your check register that appear on the bank statement. The idea is to compare your checkbook register with the bank statement to be sure each entry is accurate and that the arithmetic is correct.

0 kommentar(er)

0 kommentar(er)